Texas: How to Calculate Child Support

In a final order affecting a child or children, the court can order three different types of child support. The court can order current child support, which is an amount a party is ordered to pay in the future once the case is completed. The court can also order medical child support, which includes dental insurance. Finally, the court can order retroactive child support to compensate for childcare expenses up to four years prior to the start of the suit.

Current child support is calculated by 1) determining the monthly “net resources” of the party ordered to pay (also known as the obligor), 2) applying the Texas Child Support Guidelines against the monthly “net resources” amount, and 3) adjusting the child support amount with any deviating factors.

1. Determine the monthly “net resources” of the spouse ordered to pay

“Net resources” is determined by adding all of the obligor’s sources of income and deducting certain items such as taxes, union dues, and any health insurance for the child or children.

2. Apply the Texas Child Support Guidelines

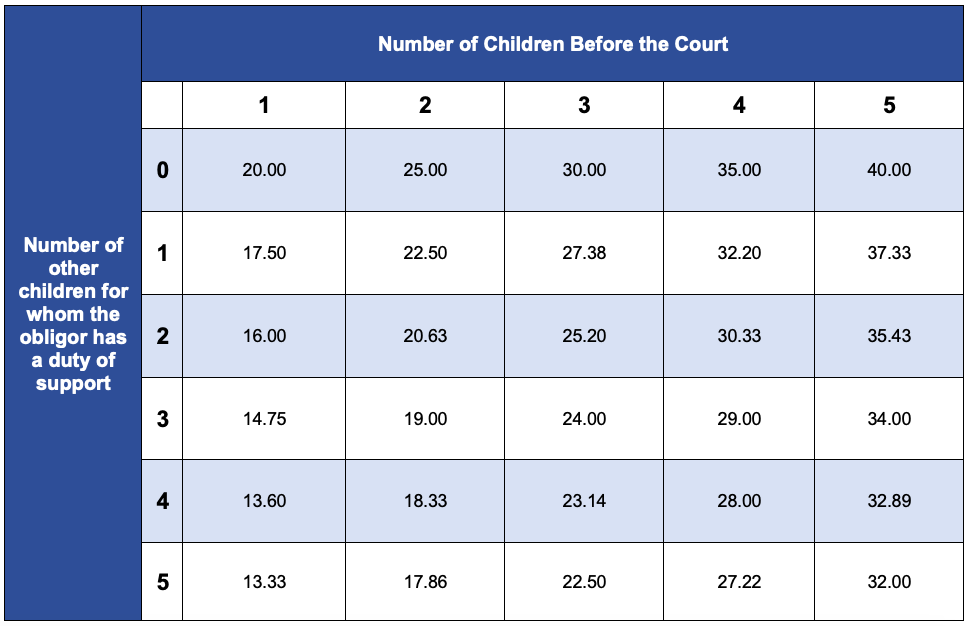

Once the monthly “net resources” amount is determined, it is applied against the Texas Child Support Guidelines to determine the child support amount. Child support is calculated based on percentages. Below is a chart of the applicable percentages.

For example, if the obligor has three children involved in the case before the court and zero children for which he or she is currently paying child support for, the child support amount will be 30% of the obligor’s monthly “net resources.”

Another example, if the obligor has two children involved in the case before the court and one child for which he or she is currently paying child support for, the child support amount will be 22.50% of the obligor’s monthly “net resources” for the case pending before the court.

3. Subtract deviating factors

The court can order the obligor to pay more or less than the amount calculated using the guidelines. Some of the factors the courts can use to deviate from the amount include the age and needs of the child, travel costs for visitation, and extraordinary educational, healthcare, or other expenses of the child. This is not an exhaustive list.

DISCLAIMER: The following information found on www.legalattraction.com is provided for general informational purposes only. It may not reflect the current law in your jurisdiction. No information contained on this website should be construed as legal advice or the creation of an attorney-client relationship. This information is not intended to be a substitute for legal representation by an attorney.

SIGN UP FOR A FREE TEXAS SELF-HELP DIVORCE KIT